- column

- TAX PRACTICE CORNER

Documenting virtual currency transactions

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

Businesses urge Treasury to destroy BOI data and finalize exemption

How to ease taxes on inherited IRAs

Company lacks standing to sue ERTC advisers

CPA tax preparers should recognize that the use of bitcoin and other virtual currencies has grown, both as an investment and as a means of commerce, that it has tax consequences, and that it is an IRS target. Consequently, their client tax organizer questionnaire should ask, “Did you ‘mine,’ buy, sell, or exchange a virtual currency; use a virtual currency to pay for goods or services; or receive a virtual currency as payment for goods or services?” (See also “Tax Practice Corner: Trading Virtual Currencies,” JofA, Nov. 2017, with links to earlier articles.) This article addresses various virtual currency issues, including how to document and perform necessary tax calculations for transactions involving a virtual currency.

GROWING CIRCULATION

Notice 2014-21 defines a virtual currency as:

a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value. In some environments, it operates like “real” currency — i.e., the coin and paper money of the United States that is designated as legal tender, circulates, and is customarily used and accepted as a medium of exchange in the country of issuance — but it does not have legal tender status in any jurisdiction.

Simply, a virtual currency (also called a crypto- currency) is accepted as currency by its users. Virtual currencies are offered in “initial coin offerings” and verified and recorded by “miners.” They are bought for investment, exchanged for fiat or other virtual currencies, and offered and accepted as payment for goods and services. They trade daily on virtual currency exchanges and, as investments, can be volatile and risky but lucrative.

Some retailers and service providers accept bitcoin (BTC), including Expedia.com, Microsoft, Overstock.com, and Dish Network. BTC automatic teller machines exist, and companies issue cards that provide seamless conversion from virtual to “real” currency for retail payments.

IRS ENFORCEMENT ACTIVITY

Most virtual currency transactions are not subject to tax information reporting and probably are underreported by taxpayers. In 2016, the IRS formed a virtual currency investigative team. By examining Form 8949, Sales and Other Dispositions of Capital Assets, the IRS found that only 807, 893, and 802 taxpayers reported BTC transactions in 2013, 2014, and 2015, respectively. The IRS issued a summons for Coinbase Inc., one of the largest virtual currency exchanges with over 500,000 active accounts, to identify U.S. customers and obtain transaction records from 2013 to 2015. The IRS then narrowed its request to accounts that engaged in transactions worth $20,000 or more; on Nov. 28, 2017, a district court granted enforcement of this narrowed summons, further restricting some of the information sought.

TAX TREATMENT

Unless noted otherwise, the following description of the tax principles involved in virtual currency transactions is based on the limited guidance provided in Notice 2014-21.

Miners

Miners use computer arrays to solve complicated algorithms to validate and record virtual currency transactions in “blocks” on a public ledger known as “blockchain,” which time-stamps and contains every transaction. Miners are compensated in virtual currency and include in gross income the fair market value (FMV) of the virtual currency, measured in U.S. dollars, on the date received, which becomes its basis.

If mining constitutes a trade or business of the taxpayer, the net earnings from self-employment (generally, gross income less allowable deductions) are subject to self-employment tax.

Sales or exchanges

Virtual currency is treated as property. The character of gains and losses generally depends on whether the virtual currency is a capital asset in the taxpayer’s hands. Therefore, if virtual currency is held for investment, its disposal generates a taxable capital gain or deductible capital loss. If it is held by an individual for personal use, its disposal produces a taxable capital gain or a nondeductible (unless by casualty or theft) capital loss. If not a capital asset (e.g., inventory), it creates ordinary gain or loss. Because virtual currency is not considered currency, no foreign currency gain or loss occurs.

For example, a U.S. investor opens an account, funds it with U.S. dollars, and, in a transaction entered into for profit, purchases virtual currency (the purchase price is its basis), which is held in a virtual wallet (a software application for holding, storing, and transferring virtual currency). To exit the position, the investor sells the virtual currency for cash or exchanges it for another virtual currency, producing a taxable capital gain or a deductible capital loss.

However, if a taxpayer uses a virtual currency account solely for personal purchases (e.g., a pay-per-view movie rental, TV set, etc.), the virtual currency is personal-use property, which can result in a nondeductible capital loss. For example, if a taxpayer buys BTC for $3,200, which drops to $2,000 in value, and then purchases a $2,000 TV, the taxpayer incurs a $1,200 nondeductible capital loss. With the potential for numerous daily purchases that create capital asset transactions, the recordkeeping burden and nondeductible capital loss treatment make using virtual currency impractical and ill-advised for these purchases.

What if one virtual currency account is used for both trading and personal use? Is the virtual currency investment property or personal-use property? Are capital losses deductible or nondeductible? Although we believe that virtual currency is usually held to make a profit, which defines its character as investment property, others suggest that the ultimate virtual currency use (e.g., to buy personal-use property) defines its character. Unless and until the IRS provides guidance otherwise, taxpayers that have virtual currency with unrealized losses should sell the virtual currency, deduct the capital losses from the sale, and make retail purchases with cash. These actions remove any appearance of personal use.

Recordkeeping

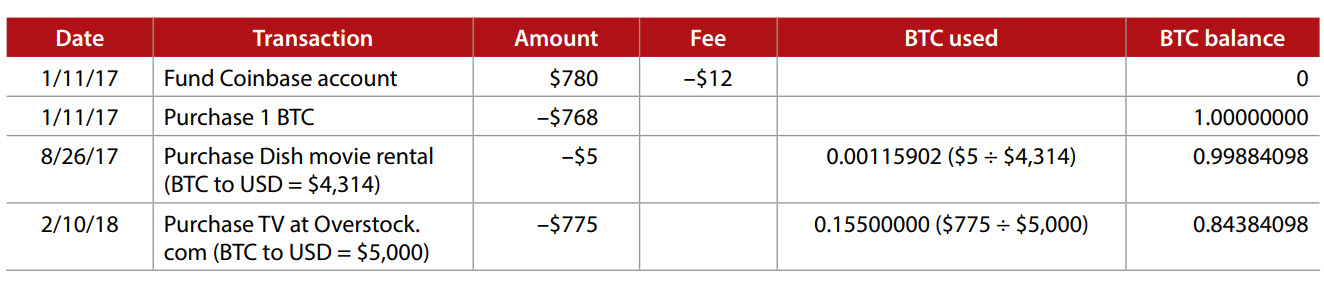

Because tax information reporting is lacking, taxpayers bear a tedious recordkeeping burden, especially since BTC account balances are typically recorded to eight decimal places, as illustrated in the chart “Bitcoin Transaction Ledger.” Note, too, the gain resulting from a more than 700% increase in the BTC to U.S. dollar (USD) exchange rate in 2017, with values shown in the example close to the actual historical closing prices on those dates on coinbase.com. The hypothetical rate of $5,000 in February 2018 appears possible; in mid-November it was above $7,500. However, as mentioned earlier, values are volatile; there have also been steep decreases.

Bitcoin transaction ledger

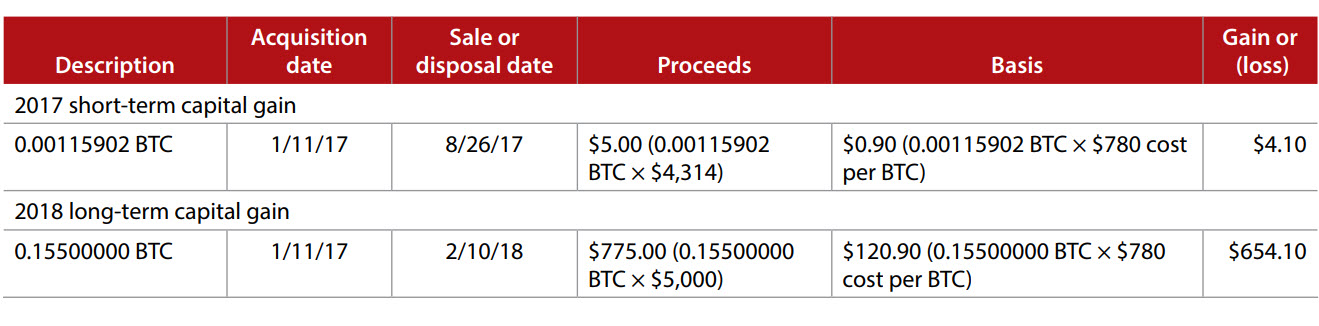

Tax reporting for these transactions is shown in the chart “Bitcoin Tax Accounting.”

Bitcoin tax accounting

Payment as employee compensation

If an employer pays an employee for services with virtual currency, the FMV of the virtual currency is considered wages, subject to federal income tax withholding, Federal Insurance Contributions Act tax, Federal Unemployment Tax Act tax, and reporting on Form W-2, Wage and Tax Statement. A person in a trade or business who pays an independent contractor $600 or more for services (as measured by the FMV of the virtual currency in U.S. dollars on the payment date) must report it on Form 1099-MISC, Miscellaneous Income. Similar to other payments made in property, payments made in virtual currency are subject to backup withholding.

A NEW AGE

Tax preparers are in a new age and cannot ignore the tax implications of virtual currency transactions. If a client is experimenting in this new market, a preparer should obtain all virtual currency documentation, e.g., printouts of virtual wallets, purchases, exchanges, etc. No tax preparer wants an unprepared client if a significant virtual currency audit adjustment is proposed.

Edward W. Adams (eadamscpa@aol.com) is president of Adams & Associates PC in Thompson, Pa., and assistant adjunct professor of finance at Rider University, Lawrenceville, N.J., where Alan R. Sumutka (sumutka@rider.edu) is an associate professor of accounting.

To comment on this article or to suggest an idea for another article, contact Paul Bonner, senior editor, at Paul.Bonner@aicpa-cima.com or 919-402-4434.