- feature

- PERSONAL FINANCIAL PLANNING

Help clients balance retirement and education planning

Remind clients that retirement should take priority over helping their children pay for college.

Please note: This item is from our archives and was published in 2018. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

What CPAs should know about Trump accounts

How to ease taxes on inherited IRAs

Cost-of-living increases could hurt 2026 financial goals, poll says

Many clients are now approaching their retirement years while simultaneously preparing to send children to college. They often struggle with the question of whether to prioritize saving for retirement or helping their children afford higher education. CPAs can help them balance these goals and make effective and efficient planning decisions in a timely fashion. Here are some general principles to keep in mind as you advise families faced with these complex decisions.

CLIENTS MUST PRIORITIZE THEIR OWN FINANCES BEFORE HELPING THEIR CHILDREN

Conversations with clients who are simultaneously planning for college and retirement should center on the premise that parents must help themselves before they can help others. It is natural for parents to want to support, protect, and provide for their children by putting their needs first. However, often parents want to help their children pay for college in ways that can jeopardize their own financial well-being.

I like to make sure my clients walk away from our meetings understanding that they need to be in a position of financial independence or have a solid plan in place before they assist their children with making material financial decisions. I liken it to the announcements that flight attendants make about handling the oxygen masks in the event of an emergency: “If you are traveling with a child or someone who requires assistance, secure your mask first, and then assist the other person.”

CPAs should be sure to demonstrate what the consequences could be if parents do not put their own financial interests first (see the sidebar “One Family’s Story”). For example, you can point out that, if clients use funds they had set aside for retirement to help pay for their children’s college expenses today, they may not be in a position to help their children with a future home purchase, a wedding, or raising grandchildren. The parents may very well become dependent on their children in the future for financial support.

Clients also must consider the more immediate consequences of withdrawing money early from qualified retirement accounts from tax and investment planning perspectives. For example, though clients who take early distributions from IRAs may avoid the 10% additional tax if the funds are used to pay qualified higher education expenses, federal and/or state income taxes may still be due. Tapping retirement funds early can also negatively impact the positive effects of tax-deferred or tax-free compounding growth, which can leave parents with a smaller nest egg at retirement.

Here are a few best practices for working with clients who are planning for both retirement and their children’s educational expenses:

Recommendation No. 1: Explain that you can borrow for college, but not for retirement

Parents sometimes wish to use funds they have already accumulated and set aside for retirement for their children’s college expenses. In these cases, CPAs can explain that various financing options are available to parents and students to pay for college (see “Ways to Pay for College” below for examples).

Make clients aware that, while financing options for higher education are abundant and easily accessible, options for financing retirement expenses are more limited. Many retirees cannot benefit from the same variety of loan and financing options as students, due to their age and limited earning potential. However, it is also important to note that just because education loan options are available for parents, it doesn’t mean they should be used in every instance.

Ways to pay for college

Students

- Federal subsidized education loans (Direct Stafford, Perkins).

- Federal unsubsidized education loans (Direct Stafford, Graduate PLUS).

- Private education loans.

Parents

- Federal unsubsidized education loans (Parent PLUS).

- Private education loans.

- Home-equity loans.

- Home-equity line of credit.

More information on federal education loans and the repayment options available can be found at studentloans.gov. Source: studentloans.gov.

Recommendation No. 2: Involve children in planning

Not only is it good to talk with parents about what the future may look like if they put their children’s needs before their own, but it can also be effective to have this conversation with high school- and college-age children. Educating clients’ children about the financial consequences of their college financing decisions can help them make better choices for themselves and their parents.

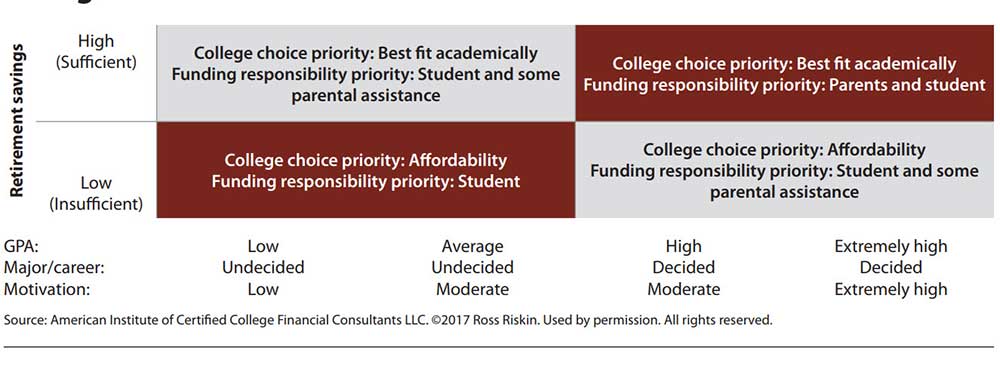

For example, you can show clients’ children information on topics such as the loan payments they will be required to make, what starting salaries are in their chosen major/career field, and the costs they may not yet have considered, such as insurance and income taxes, to help them gain a better understanding of the financial burden they and their parents are about to undertake. I also encourage clients’ children to give serious thought to how their college choices may affect their lives. If they are looking at colleges their family cannot afford, aren’t serious students, or don’t know what their career aspirations are, their college choices may need to change. (See “A Tool for Prioritizing College Funding Decisions,” below, which includes a matrix that considers many of these factors in different combinations.)

Also, have clients consider whether their children should have some “skin in the game” by taking out loans in their own names. Introducing students to the implications of borrowing and having them take responsibility for their choices can be a powerful learning opportunity. It can offer them the chance to establish smart financial habits and work with their parents, and not against them, to make paying for college a reality.

A tool for prioritizing college funding decisions

When deciding where their children should go to college and who should pay for it, clients need to take into account such factors as their readiness for retirement and their children’s academic status and future plans. Below is a decision grid I created to help clients weigh these factors, which you can customize and use when advising clients in your own practice. The grid can serve as a general starting point, though it is important to remember every client’s situation is unique, and that adjustments will likely need to be made. When in doubt, I would advise weighing the quantitative retirement savings more heavily than the qualitative academic factors.

College choice decision chart

Recommendation No. 3: Remember that tuition won’t be the only cost

Even though tuition and room and board will likely be the largest educational expenses your clients and their children will incur, remind them to budget for other expenses as well. Students will need money for entertainment, textbook purchases, travel, occasional off-campus dining, and the like. Travel expenses, in particular, can be substantial, especially if a child is attending an out-of-state school and wishes to come back home for every holiday or school break. These costs are often overlooked in the planning process, but taking them into account can make the distribution phase a little less daunting and more predictable from a financial planning standpoint.

Recommendation No. 4: Learn more about college costs and student loans

I encourage CPAs to become more knowledgeable in the areas of college and student loan advising in order to better serve their existing clients and future generations. CPAs can familiarize themselves with the information provided on sites such as studentloans.gov, collegeboard.org, collegedata.com, and collegeresults.org to learn more about these topics. It also is important for CPAs and planners to keep up to date with this information and receive more streamlined guidance by attending continuing education courses on topics such as college funding or student loan advising. CPAs can also focus on building relationships with guidance counselors and other financial professionals who work in these fields, so they can refine their competencies and be in a position to offer effective advice for clients.

We also need to move beyond simply advising families to save money in a 529 college savings plan. When having the college conversation, we need to be able to talk to clients about creative strategies such as attending a community college, taking a gap year, exploring online education opportunities, implementing tax-planning strategies before the base financial aid income year, and timing 529 college savings plan distributions effectively (see “Clients Can Save for College Before Children Enter the Picture” for other 529 planning strategies). All of these strategies, and more, can be used to reduce the costs of higher education while enhancing the long-term value and opportunities it can provide. We need to move the college conversation with our clients from “small talk” to “smart talk,” all while remembering that planning for retirement should take precedence.

Clients can save for college before children enter the picture

Parents can start saving for their children’s college expenses long before the children are born, with the use of taxable investment accounts or 529 college savings plans. Clients can set up such an account or plan and name themselves as the beneficiary. (Note that they can only name a single beneficiary per plan.) When they have a child, they can then name that child as the beneficiary, which means they will be making a gift equal to the fair market value of the account at that time.

This may be a conversation worth exploring with clients who are recently married or those who plan on having children in the next few years. We all know that raising children can be expensive and that costs can come in a “fast and furious” fashion. Some clients may be in a better position to set aside a substantial sum of money for college before they have children.

One family’s story

Clients often exhibit behavioral biases (emotional and cognitive) that CPAs need to be aware of. Our job as CPAs is to communicate objective advice, which can be difficult to do with clients who are planning for college and retirement — two areas where subjectivity is a key element. CPAs need to persuade clients to think logically by demonstrating how emotion-driven choices can have serious financial consequences.

As one example, a client couple I recently met with wanted to help pay the out-of-state tuition and room and board costs for their daughter by borrowing $40,000 per year for four years via Parent PLUS Loans (unsubsidized federal education loans). These parents were adamant about doing this, but they also owed $30,000 in back taxes and were both 56 years old with less than $10,000 set aside for retirement. What’s more, their daughter was a below-average student and had no defined major or career interests. This truly was the perfect storm for a financial disaster.

Suffice it to say, I had to show them what borrowing $160,000 would cost in loan repayments and that they would likely be in a position in the future where their wages and/or Social Security income would be garnished. I let them know that they desperately needed to reprioritize their objectives and put the tax and retirement planning issues ahead of college funding. After several meetings and conversations, I was finally able to persuade them to do just that. I involved their daughter in the discussions as well, which enabled her to make the decision to attend a more affordable school that would reduce the family’s annual tuition and room and board costs by approximately $30,000.

About the author

Ross Riskin (ross@rossriskin.com) is the founder of the American Institute of Certified College Financial Consultants. He is also the managing member of Riskin Advisory LLC and vice president of Riskin & Riskin PC, and serves as the director of finance programs and assistant professor of accounting and finance at Albertus Magnus College in New Haven, Conn.

To comment on this article or to suggest an idea for another article, contact Courtney Vien, senior editor, at Courtney.Vien@aicpa-cima.com or 919-402-4125.

AICPA resources

Articles

- “Student Loans: What You Need to Know Before Signing,” JofA, Jan. 2017

- “3 Steps Clients With Kids in College Need to Take,” CPA Insider, March 21, 2016

CPE self-study

- Education Planning (#166680, online access)

For more information or to make a purchase, go to aicpastore.com or call the Institute at 888-777-7077.

Online resources

- Brochure: Tuition Tips: Spotlight on College Costs, aicpa.org (member login required)

- CPA Mobilization Kit: High School — Bridging the College Savings Gap With Financial Aid, aicpa.org

- CPA Mobilization Kit: Parenthood — Making College a Reality, aicpa.org

Videos

- “MONEY MINUTES — College Costs 101,” aicpa.org

- “Saving and Spending 101 — What College Students Need to Know About Loans and Budgeting,” aicpa.org

Webcasts

- “Advising Clients on Planning for Education,” aicpa.org

- “Plan Before You Borrow: What You Should Know About Planning for College Education,” aicpa.org

PFP Member Section and PFS credential

Membership in the Personal Financial Planning (PFP) Section provides access to specialized resources in the area of personal financial planning, including complimentary access to Broadridge Advisor. Visit the PFP Center at aicpa.org/PFP. Members with a specialization in personal financial planning may be interested in applying for the Personal Financial Specialist (PFS) credential. Information about the PFS credential is available at aicpa.org/PFS.