- feature

- TAX

A new discipline for tax

The emerging area of tax information and operations management helps CPAs add strategic value to their organizations.

Please note: This item is from our archives and was published in 2017. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

IRS proposes regulations for Trump accounts, pilot program

IRS seeks to scrap basis‑shifting TOI reporting regulations

IRS Dirty Dozen adds new capital gains scheme for 2026

Whatever your perspective—citizen, CPA in public practice, accountant in business and industry—the word “tax” can carry many negative connotations. But what if you heard that a new field within the accounting profession is seeking to transform tax from a center of compliance into a driver of value? What would pop into your mind then?

Brian Morris, CPA, executive director and leader of enterprise tax technology services with EY’s Tax Performance Advisory practice, suggests that the topic of tax should evoke questions—ones crucial to the success of your business or practice. “Given the global focus on tax and its pervasive impact on businesses, the key questions CEOs, CFOs, and managing partners should be asking are, ‘Do we have the right information to properly manage tax within our organization? Am I giving tax the right support and resources to perform the job I need them to? Can they accomplish their objectives? Can tax extend beyond being a cost center to add value to the organization? How do I do this?’ “

The answer to those questions may be found in a new way of thinking about tax. This article examines the emerging discipline of tax information and operations management and explores how CPAs can apply this discipline to make positive changes in the tax function, both in public practice and business and industry.

“For many businesses and firms, a focus on operations is not new, but understanding the criticality and application of these principles within tax is alternative to traditional thinking,” said Lauren Kovar, CPA/CITP, CGMA, director of Client Advisory & Strategy for Thomson Reuters and chair of the AICPA Tax Information & Operations Management (TIOM) Task Force, which was created to help fill the gap in understanding about this growing area of tax. As part of that process, the task force developed the tax operations framework (see the sidebar “The Tax Operations Framework Explained“), which provides practitioners with a blueprint for successfully implementing tax information and operations management to transform their tax function.

“In the past five years, we have seen more and more tax professionals embrace foundational tax operations and incorporate the framework into everything they do,” Kovar said. “New terms such as ‘taxologist’ and others are being used to describe this expanded role of the tax professional.”

WHAT IS TAX INFORMATION AND OPERATIONS MANAGEMENT?

Tax information and operations management can be defined as overseeing, designing, and controlling tax-related information and processes while ensuring that tax operations are efficient in terms of using as few resources as needed and effective in terms of meeting stakeholder requirements. Effective tax operations are an essential element of well-run corporate tax departments and profitable public accounting tax practices. Operations are becoming the key driver for successful tax professionals, with the timeliness and accuracy of tax outcomes directly tied to the data, information, processes, and technologies that deliver those results.

“Tax implications are everywhere in business,” Kovar said. “There is a tax consequence to every transaction and pretty much every movement—whether people, products, or intellectual property—made by businesses big or small. This translates into exponential amounts of data and information that must be managed in an increasingly complex regulatory environment. Tax professionals can no longer afford to employ traditional or manual methods to produce their results, bringing us to the necessity of a foundational operations approach for tax.”

DEFINING THE PROBLEM

A recent survey from PwC and the Manufacturers Alliance for Productivity and Innovation (MAPI) of more than 100 companies found that 77% had no tax technology strategy, with the majority of those having no plans to develop one. In addition, PwC and MAPI reported that “only 7% of survey respondents’ tax departments spend more than 50% of their time analyzing data.” This translates to 93% of companies not focusing tax resources effectively—in other words, a gap exists in their operations management.

Historically, CPAs and other tax professionals could work around this gap. The tax function always managed to get the job done and support the business, but this often was accomplished through sheer determination and exceptional effort. Visualize a “man behind the curtain” frantically trying to keep everything running. To the organization outside of tax, everything appears to be running smoothly, but what cannot be seen is the real effort that has gone into creating the result. As the changing tides continue to flood tax, this is no longer a sustainable model. The evolving tax landscape now prevents the “man behind the curtain” from being able to keep up.

“The way companies and providers do tax work is going through an unavoidable transformation that has evolved the nature of tax processes, technology, and operational strategy,” said Craig Darrah, managing director in Deloitte’s Tax Management Consulting Practice leading efforts related to robotics and cognitive automation and a member of the TIOM Task Force. “Tax professionals must embrace this fact and take steps to grow their skills and understanding.”

An area most in need of improvement is data processing and management. Tax professionals have long used spreadsheets to pull together and manage their data, in addition to modifying the data so they can be used for tax purposes. CPAs employ complex formulas, VLOOKUPs, links between workbooks, and PivotTables as the “solution” for managing and modifying data from multiple sources and/or entities.

Spreadsheets may work well at the inception of a process or function, but as businesses grow, mergers happen, and other complexities arise, tax professionals find themselves slapping Band-Aids on the problem and force-fitting spreadsheets to resolve their data management issues. The same is true for practitioners and consultants who serve clients. Tracking basis, carryovers, depreciation, and other client data may originally work fine with the use of spreadsheets, but as a client’s tax situation gets more complicated, spreadsheets may no longer be the best tool. Risk is directly correlated to how the data are obtained and managed.

“The reason everyone loves Microsoft Excel is also its biggest weakness—ease of use,” Darrah said. “Spreadsheets are managed by individuals, and human error is inevitable.”

Keeping up with the data is the largest, but not the only, operational challenge tax faces. Other operations obstacles occur in the following areas:

- Collaborating between the tax and finance teams. This is essential to many tasks, such as being able to close the books in a timely fashion and making intelligent, strategic financial decisions. Often, finance systems have been set up to meet internal and external financial reporting needs, but not tax. This means the tax team has to modify, or transform, the finance data to comply with tax requirements. One example is the detail required to calculate book-tax differences for the tax return or tax provision. The tax team has to comb through individual transactions to identify which items are or are not deductible for tax. If the finance system was set up to flag those transactions, the tax team could calculate the book-tax differences more quickly with greater accuracy.

- Managing documents and content. This category encompasses how documents are created, stored, shared, and reviewed, and how staff can collaborate and sign off on them. Another key function is being able to locate files in storage, often for an audit.

- Using email. This refers to using email too much—and often inappropriately—for exchanging document files, sending responses to important issues, and storing key data. Unencrypted email absolutely should not be used for transmitting confidential information. And even if it is encrypted, email often is not the most efficient or effective method anyway.

- Managing tax deadlines. The challenges here arise from the difficulty in effectively tracking all tax-related due dates (income tax, sales/use tax, payroll tax, etc.), especially when they change.

- Having multiple versions of key workpapers. This makes it difficult to know what is “final.”

- Giving too much control to one tax person. When he or she leaves the organization, it’s a challenge to pick up the pieces.

“Tax departments are asked to do more with less—limited resources, limited IT investment, and less time,” Kovar said. Because of these issues, and other challenges to effectively manage tax information, more tax professionals are embracing emerging technologies (see the sidebar “Technology Trends in Tax Operations“). In addition, organizations are pushing for more optimized procedures and technologies to support end-to-end tax processes and produce timely and accurate results that mitigate risk and protect their reputation while also justifying IT spending.

IMPLEMENTING THE FRAMEWORK

To best oversee, design, and control tax operations efficiently and effectively, it is important to understand and apply the tax operations framework developed by the TIOM Task Force.

“It is important for savvy tax professionals to recognize that implementing technology alone is not an effective operational strategy,” said David A. Kovar, Ph.D., a managing director at VPTax, a member of the TIOM Task Force, and Lauren Kovar’s husband. “The intersection of all the elements of the framework must be considered when evaluating any system and determining whether your firm or company should move forward.”

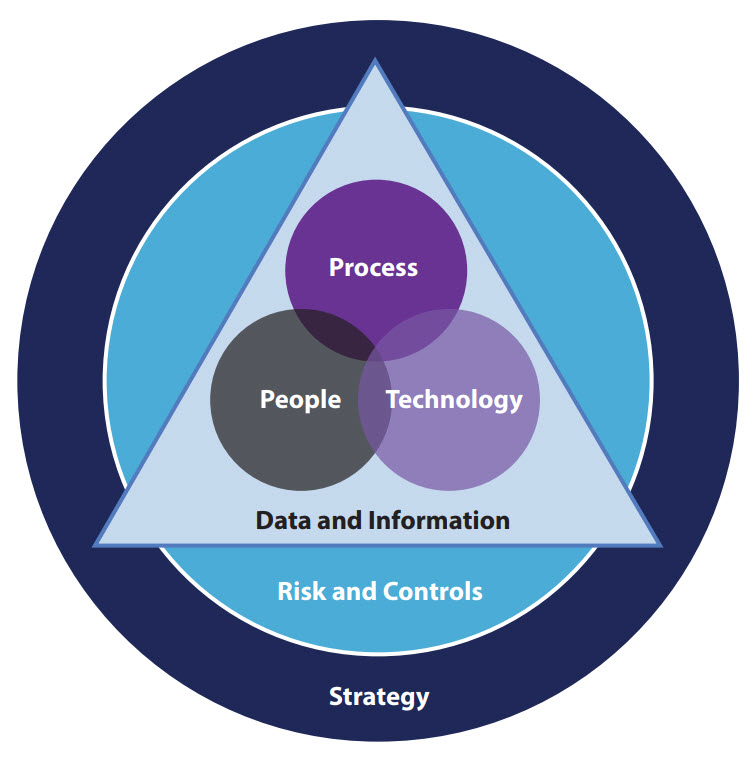

The interconnection of all the framework’s elements drives the success for tax operations, technology, and data management. This interconnection is illustrated in the “Tax Operations Framework” graphic.

Tax professionals, key business stakeholders, and C-suite leadership would be wise to critically address the framework components as they specifically relate to their businesses. Following is a checklist highlighting some actions successful tax leaders have taken to transform their tax operations and apply the concepts of the tax operations framework.

Tax operations framework

ACTION ITEMS FOR SUCCESS

Ensure tax participates in the organization’s strategic and day-to-day operations

As a vital part of the business, the tax impact can be the pivotal data point that makes or breaks a business decision. The tax department should shift the primary focus away from meeting compliance and reporting obligations toward aligning operations to better serve the business strategy. If possible, develop a role for a tax operations strategist or technologist, someone who focuses on short- and long-term operational goals for tax, as well as the enabling processes and technologies your tax team needs to get their job done.

Assess your process and technology landscape

Even the best systems have areas to improve. Ensure that the business isn’t falling into the trap of overusing spreadsheets and/or spending too much time on the compliance component and not enough time adding value. Consider adding and/or improving signoffs to decrease risk. Also, consider employing workflow technology to streamline all steps.

Tax professionals are generally aware of the landscape of systems and processes supporting their daily activity. A proper assessment entails more than having a general knowledge of your systems and a detailed understanding of your tax processes. It involves drilling a layer deeper to look at the world from different angles to capture the full picture of what truly exists. An assessment must include both the macro and micro and should be performed from several perspectives. Your assessment is a critical component and is many times passed over casually because we think we already know our own environment. (For more on technology assessment, see the Thomson Reuters ebook, 4 Steps to Evaluating Tax Technology, available at tax.thomsonreuters.com.)

Understand the needs of all stakeholders: Improve communications

Again, tax implications are everywhere. Tax undertakes many activities in collaboration with other areas of the organization. Tax’s ability to run effective and efficient processes affects stakeholders downstream. At the same time, other areas of the organization may own the data tax needs to complete its role. It is important to identify who needs what and when they need it. In the example of a year-end close process, the tax team is usually the last to get the data and finalize the numbers. This puts a lot of pressure on tax to perform and avoid being a bottleneck. Strong processes and technology, along with proactive communications with the finance team, are essential to doing this successfully. From a strategic perspective, tax leadership should always be “in the know” for transactions the company is pursuing, or may pursue, in the future.

Incorporate all elements of the tax operations framework

It’s difficult to optimize technology without looking at data and process. Controls should be closely aligned with risk and strategy. Never use technology without a clear strategy and known business requirements. Tax leadership must find the right balance between all these aspects, even under the continued pressure of any cost-cutting and resource limitations they may be facing.

Develop and track a set of success metrics

Don’t forget to track your progress against a set of well-defined and measurable metrics that can be used to support your results.

ADDITIONAL ACTION ITEMS

The above five steps are also relevant for tax practitioners, firms, consultants, and small or midsize businesses and should be scaled to fit the size and scope of your tax operations. Additional steps tax practitioners and consultants serving clients can take include the following:

Perform a workflow analysis

Practitioners should scrutinize their current workflow, working to eliminate useless procedures and unneeded approvals that can lead to significant costs and delays. Often, tax practices (especially smaller ones) devote most of their technology attention to tax preparation software. However, they are focusing on the “end game,” i.e., the return, while neglecting all the steps leading up to the final product. Without careful processes and technology in place, practitioners are working harder than they need to, and making less profit than they should be (for additional insight, listen to the AICPA Tax Section podcast on workflow automation, available at aicpa.org.

Revisit billing processes

Is too much time spent on time sheets and non-value-added services? Many practitioners are finding success by eliminating the time sheet and moving toward value pricing (see the June 2009 JofA article “Pricing on Purpose: How to Implement Value Pricing in Your Firm.”

Perform a client security assessment

Tax practitioners should feel more than confident that their systems are secure. With the threat of identity theft growing exponentially, practitioners need to have the system and protocols in place to ensure client information is kept safe. When a client experiences identity theft, it’s a mess to clean up. When a practitioner experiences identity theft, it can be catastrophic and affect hundreds, if not thousands, of clients (and potentially put a practitioner out of business). A simple assessment and rating (from one to 10) of client data security operations will help identify next steps to ensure effective processes around how client confidential information is obtained, transferred, and stored. For some practical considerations, review the Tax Section’s Best Practices for Keeping Client Data Secure, available at aicpa.org, and read the October 2014 article from The Tax Adviser, “Securing Client Data: A Fundamental Priority.”

Envision ‘perfect’ practice management

Set long-term goals and identify short-term improvements. Each firm has its own strategy, client composition, needs, and budget constraints, but it’s worth taking the time to step back and think about how things could run in a perfect world. It often is possible to make at least some of those ideas a reality. For many practitioners, adding simple and inexpensive technology to enable staff (and partners) to work remotely is a game-changer. Or going paperless could save so much time and money (and trees) that one might wonder why this wasn’t done sooner.

“All tax professionals are impacted by the shifting paradigm that puts a spotlight on tax information and operations management—whether a sole practitioner serving small clients, a partner in a public accounting firm, or a chief tax officer of a large multinational corporation,” said Anne Giffels, CPA, director and leader of the Income Tax Technology Practice at Ryan LLC and a member of the TIOM Task Force. “Ironically, firms and tax professionals in the public accounting space are the least plugged in to this area, but they are doubly impacted—both in their role as the ‘tax department’ of their clients and within their own firm’s operations.”

A LARGER ROLE FOR TAX

What’s the next step for tax departments and professionals interested in the emerging discipline of tax information and operations management? To get started, embrace the notion that tax can and should extend beyond being a cost center to one that adds strategic value to the organization. Be open-minded to process improvements and other changes. Do a deep analysis of the organization’s core TIOM processes and work toward implementing strategies to drive long-term success.

If all goes well, the result will be a new, profitable direction for your tax function and maybe even a new connotation for the word “tax” in your mind.

The tax operations framework explained

The tax operations framework developed by the AICPA Tax Information & Operations Management Task Force consists of the following key components: strategy, risk and controls, data and information, technology, people, and process. The framework should serve as a guide to help professionals focus their approach and conceptualize how these aspects interrelate. All of the framework components need to be addressed to effectively run the operations of the tax function.

The components are defined as follows:

- Strategy: The overall plan and approach to achieve tax’s objectives.

- Risk and controls: Operations and safeguards that must align to the actual risks.

- Data and information: Facts that are used to support tax reporting and compliance processes, driving all tax work and outcomes.

- Technology: The “enabler” to assist in tax processes.

- People: The brains behind the strategy and operations. People perform the value-added work.

- Process: The series of actions that produce or lead to a particular outcome.

Action items for implementing the framework are included in the main article under the headline “Action Items for Success.”

Technology trends in tax operations

Technology is often the aspect of operations management that we hear about the most. It is both a driver of and enabler for change. A new set of technology solutions can dramatically decrease the use of spreadsheets and tighten up control of processes. Some of the technologies changing the face of tax operations include:

- SaaS/cloud-based solutions: In-house installed technology used to be the best option. With the desire of clients, consultants, and users to have secure outside access, it is difficult for any in-house IT team to adequately secure, update, and provide support in a cost-effective manner. Cloud-based solutions from trusted SaaS (software as a service) vendors are more secure and supportable than ever. In addition, housing the solutions in a centralized location in the cloud has allowed vendors to integrate and automate their own tools, leading to even more efficiency for tax professionals.

- Robotic process automation: Robotic process automation (RPA) has gone mainstream. RPA can move and manipulate data and drive processes across multiple systems. RPA can log in to multiple existing systems; run reports, and sort and manipulate them; log in to other systems (e.g., tax); and then either type in results or import data. “There are many tax processes suitable for automating with RPA software,” said Craig Darrah, managing director in Deloitte’s Tax Management Consulting Practice leading efforts related to robotics and cognitive automation and a member of the AICPA Tax Information & Operations Management Task Force.

- Process, workflow, and document management systems (aka content management systems): In the past, it was good enough to put documents and spreadsheets on a hard drive or local network shared drive. With the increasing need to improve efficiency, provide secure access to multiple parties (e.g., clients, finance, outside providers, etc.), and track processes, tax operations have turned to content management systems to further automation and collaboration needs. The solutions vary dramatically in their functions, but all address the need for greater security, flexibility, and access.

About the author

Susan Allen (Susan.Allen@aicpa-cima.com) is a senior manager with the AICPA Tax Practice & Ethics team. She focuses on providing AICPA and Tax Section members resources and guidance to ensure CPAs remain the premier providers of tax services.

To comment on this article or to suggest an idea for another article, contact Jeff Drew, senior editor, at Jeff.Drew@aicpa-cima.com or 919-402-4056.

AICPA resources

Articles

- “Securing Client Data: A Fundamental Priority,” The Tax Adviser, Oct. 2014

- “Pricing on Purpose: How to Implement Value Pricing in Your Firm,” JofA, June 2009

CPE self-study

- Tax Staff Essentials, Level 4—Tax Manager/Director (#157863, online access; #GT-TSE.LEVEL4, group training)

For more information or to make a purchase, go to aicpastore.com or call the Institute at 888-777-7077.