| EXECUTIVE SUMMARY |  THERE IS A CLEAR TREND toward adopting IFRS as the single body of internationally accepted financial reporting standards. In the next few years, thousands of companies will move to IFRS as a primary basis of financial reporting.

THERE IS A CLEAR TREND toward adopting IFRS as the single body of internationally accepted financial reporting standards. In the next few years, thousands of companies will move to IFRS as a primary basis of financial reporting.  THE IFRS MANDATE WILL AFFECT U.S. COMPANIES. Some may be required to adopt IFRS to meet the reporting requirements of an international parent or investor company, while others may recognize the need to voluntarily supplement their current financial reporting with IFRS to allow for an accurate comparison with foreign competitors.

THE IFRS MANDATE WILL AFFECT U.S. COMPANIES. Some may be required to adopt IFRS to meet the reporting requirements of an international parent or investor company, while others may recognize the need to voluntarily supplement their current financial reporting with IFRS to allow for an accurate comparison with foreign competitors.

A U.S. COMPANY WILL HAVE TO REPORT UNDER IFRS if it is the subsidiary of a foreign company that must use IFRS; has a foreign subsidiary that must report according to IFRS; has operations in a foreign country where IFRS use is mandatory; or has a foreign investor that must report according to IFRS.

A U.S. COMPANY WILL HAVE TO REPORT UNDER IFRS if it is the subsidiary of a foreign company that must use IFRS; has a foreign subsidiary that must report according to IFRS; has operations in a foreign country where IFRS use is mandatory; or has a foreign investor that must report according to IFRS.

THE CONVERGENCE EFFORTS OF FASB AND THE IASB already have changed U.S. GAAP. As these efforts continue, their effects on U.S. GAAP will multiply. Both boards have issued exposure drafts relating to the near-term convergence of their goals, and the IASB has published several statements that narrow the differences between U.S. GAAP and IFRS.

THE CONVERGENCE EFFORTS OF FASB AND THE IASB already have changed U.S. GAAP. As these efforts continue, their effects on U.S. GAAP will multiply. Both boards have issued exposure drafts relating to the near-term convergence of their goals, and the IASB has published several statements that narrow the differences between U.S. GAAP and IFRS.

| | D.J. GANNON, CPA, and ALEX ASHWAL, CPA, are a partner and senior manager, respectively, with Deloitte & Touche LLP’s IFRS Centre of Excellence for the Americas. Mr. Gannon’s e-mail address is dgannon@deloitte.com , and Mr. Ashwal’s is aashwal@deloitte.com . |  ross-border investors often find it difficult to understand financial statements that foreign companies prepare using their respective nations’ accounting principles. But greater uniformity and efficiency are coming to the international investment community now that most public companies domiciled within the European Union (EU) will be required to use international financial reporting standards (IFRS) beginning in January 2005. This article will show CPAs how to assist their employers and clients in preparing for the impact of the EU requirements on their financial reporting.

ross-border investors often find it difficult to understand financial statements that foreign companies prepare using their respective nations’ accounting principles. But greater uniformity and efficiency are coming to the international investment community now that most public companies domiciled within the European Union (EU) will be required to use international financial reporting standards (IFRS) beginning in January 2005. This article will show CPAs how to assist their employers and clients in preparing for the impact of the EU requirements on their financial reporting.

IFRS is a body of accounting and financial reporting standards developed by the International Accounting Standards Board (IASB) (see “Players and Roles”). Every major nation is moving toward adopting them to one extent or another. The European Union requires their use, the United States and Canada are converging their versions of GAAP with IFRS and some companies in other countries are using them voluntarily. | Get Ready for IFRS More than 300 SEC-listed companies are headquartered in the European Union and thus are required to use international financial reporting standards beginning in 2005. Source: SEC, www.sec.gov , 2003.

| This trend may dramatically affect the financial reporting of U.S. companies that own, are subsidiaries of or have other relationships with foreign entities directly subject to an IFRS reporting requirement, such as that of the European Union. Many foreign companies registered with the SEC are headquartered in countries that require them to begin using IFRS in 2005; while these companies are subject to the U.S. regulatory environment, they also will have to adopt IFRS. And because U.S. regulators and rulemakers are actively supporting convergence, U.S. GAAP will evolve in tandem with IFRS and thus affect even U.S. companies with no overseas ties. CPAs’ clients and employers will need help assessing the effects these requirements will have on them. This article therefore will help practitioners explain to companies’ management how IFRS may affect their reporting obligations. INCREASING USE OF IFRS

A growing number of jurisdictions require public companies to use IFRS for stock-exchange listing purposes, and in addition, banks, insurance companies and stock brokerages may use them for their statutorily required reports. So over the next few years, thousands of companies will adopt the international standards. Countries in many parts of the world already require companies to adopt IFRS or will do so soon. The European Commission (EC)—the European Union’s legislative and regulatory arm—issued a rule that, with a few exceptions, requires all public companies domiciled within its borders to prepare their consolidated financial statements in accordance with IFRS beginning January 1, 2005. This requirement will affect about 7,000 enterprises, including their subsidiaries, equity investees and joint venture partners. Significantly, EU companies on January 1, 2005, will lose the option of using U.S. GAAP for listing purposes on foreign stock exchanges. However, under the EC regulation, EU member states may permit companies to defer adoption of IFRS until 2007 if their shares currently trade on a U.S. stock exchange and they use U.S. GAAP (see “ Players and Roles ”). EU member states also are deciding whether to require or permit the use of IFRS for statutory reporting purposes, such as for the disclosures energy utilities must make to government power authorities. The increased use of IFRS is not limited to public-company listing requirements or statutory reporting. Many lenders and regulatory and government bodies are looking to IFRS to fulfill local financial reporting obligations related to financing or licensing. Players and Roles

The European Union is an economic and political alliance of European states with 25 members (see exhibit 2 ). The European Commission, the European Union’s authoritative legislative body, issues accounting, financial reporting and other rules.

The European Union is an economic and political alliance of European states with 25 members (see exhibit 2 ). The European Commission, the European Union’s authoritative legislative body, issues accounting, financial reporting and other rules.  The Financial Accounting Standards Board (FASB) is well-known to CPAs as the designated organization in the private sector for establishing standards of financial accounting and reporting. Consequently, it has been the primary U.S. representative in collaborative efforts to converge U.S. GAAP with IFRS.

The Financial Accounting Standards Board (FASB) is well-known to CPAs as the designated organization in the private sector for establishing standards of financial accounting and reporting. Consequently, it has been the primary U.S. representative in collaborative efforts to converge U.S. GAAP with IFRS.

The International Accounting Standards Board (IASB) is an independent, privately funded accounting standard setter committed to developing in the public interest a single set of high quality, understandable and enforceable global accounting standards that require transparent and comparable information in general purpose financial statements. The board also cooperates with national accounting standard setters—including FASB—to achieve convergence among standards around the world.

The International Accounting Standards Board (IASB) is an independent, privately funded accounting standard setter committed to developing in the public interest a single set of high quality, understandable and enforceable global accounting standards that require transparent and comparable information in general purpose financial statements. The board also cooperates with national accounting standard setters—including FASB—to achieve convergence among standards around the world.

The SEC has supported the work of the IASB and repeatedly stressed the importance of convergence of accounting principles under IFRS and U.S. GAAP. In March the SEC proposed amendments to Form 20-F, Registration of Securities of Foreign Private Issuers, that would affect such entities adopting IFRS. The proposals’ purpose is to ease the burdens foreign companies will face when they adopt IFRS for the first time, to improve their financial disclosure to investors and to encourage other foreign companies to voluntarily adopt IFRS.

The SEC has supported the work of the IASB and repeatedly stressed the importance of convergence of accounting principles under IFRS and U.S. GAAP. In March the SEC proposed amendments to Form 20-F, Registration of Securities of Foreign Private Issuers, that would affect such entities adopting IFRS. The proposals’ purpose is to ease the burdens foreign companies will face when they adopt IFRS for the first time, to improve their financial disclosure to investors and to encourage other foreign companies to voluntarily adopt IFRS.

| IMPACT ON U.S. ENTITIES

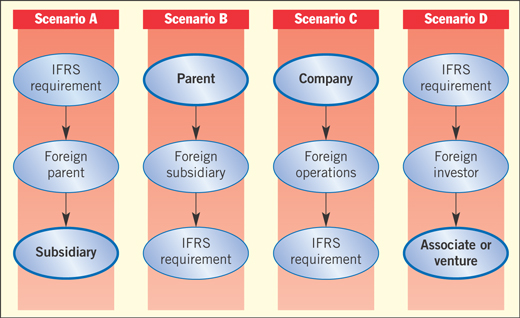

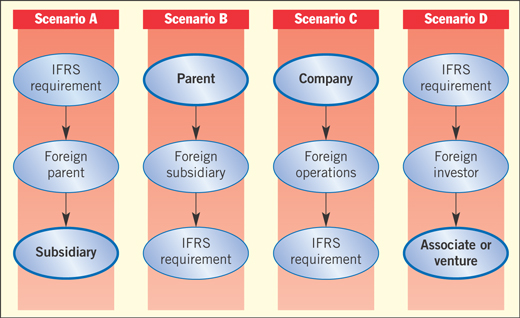

Although the use of IFRS isn’t required in the United States, the new standards could affect the financial reporting activities of U.S. companies, regardless of their size or of U.S. reporting requirements. The following is a discussion of four possible situations in which a U.S. company would be required to use IFRS.  The U.S. company’s international parent uses IFRS. If a U.S. company has a parent headquartered outside the United States that reports on an IFRS basis and has shares publicly traded on a European exchange, the subsidiary will have to prepare IFRS information for inclusion in the parent’s consolidated financial statements (see exhibit 1 , above). In some situations a U.S. company’s financial statements previously may not have been consolidated because its parent’s local version of GAAP did not require it, but that is not so under IFRS.

The U.S. company’s international parent uses IFRS. If a U.S. company has a parent headquartered outside the United States that reports on an IFRS basis and has shares publicly traded on a European exchange, the subsidiary will have to prepare IFRS information for inclusion in the parent’s consolidated financial statements (see exhibit 1 , above). In some situations a U.S. company’s financial statements previously may not have been consolidated because its parent’s local version of GAAP did not require it, but that is not so under IFRS.

| Exhibit 1 : Potential IFRS Scenarios for U.S. Companies | | U.S. companies might be required to report under IFRS. In each column the bold oval represents the U.S. company, and the other ovals represent entities to which they are related as owners, subsidiaries or investees.

| Consolidated IFRS financial statements must be prepared using uniform accounting policies, so the subsidiary’s accounting policies must conform to its parent’s for like transactions and other similar events, such as the measurement of inventories. Unlike U.S. GAAP, IFRS does not permit inventories to be measured using the Lifo method. Therefore, the U.S. subsidiary would have to gather information on either an average cost or Fifo basis, depending on the parent’s accounting policy. CPAs who previously prepared financial statements for a U.S. subsidiary of a foreign company have experience converting U.S. GAAP-based financial statements into, for example, equivalents based on French GAAP. These practitioners will, of course, have to familiarize themselves with IFRS as a new basis of accounting.

The U.S. company’s foreign subsidiary uses IFRS. In a U.S.-headquartered multinational corporation, all subsidiaries that are publicly listed in the European Union must comply with IFRS beginning January 1, 2005. So EU subsidiaries will submit IFRS statements to the parent, which may have to convert them to U.S. GAAP for inclusion in its consolidated financial statements. Consequently, CPAs at the U.S. parent company should be aware of IFRS reporting requirements and identify and resolve any financial reporting issues related to its consolidated financial statements. To ensure their counterparts at subsidiaries are following IFRS reporting requirements, practitioners at the parent company should coordinate subsidiaries’ reporting activities. CPAs also might consider advising U.S. companies in this situation to take the opportunity to simplify their financial reporting processes by settling on IFRS as a uniform set of accounting standards for their foreign subsidiaries around the world.

The U.S. company’s foreign subsidiary uses IFRS. In a U.S.-headquartered multinational corporation, all subsidiaries that are publicly listed in the European Union must comply with IFRS beginning January 1, 2005. So EU subsidiaries will submit IFRS statements to the parent, which may have to convert them to U.S. GAAP for inclusion in its consolidated financial statements. Consequently, CPAs at the U.S. parent company should be aware of IFRS reporting requirements and identify and resolve any financial reporting issues related to its consolidated financial statements. To ensure their counterparts at subsidiaries are following IFRS reporting requirements, practitioners at the parent company should coordinate subsidiaries’ reporting activities. CPAs also might consider advising U.S. companies in this situation to take the opportunity to simplify their financial reporting processes by settling on IFRS as a uniform set of accounting standards for their foreign subsidiaries around the world.

The U.S. company has foreign operations. U.S. entities that have or are seeking to establish operations in other countries now may be required by local regulators or lenders to prepare IFRS-compliant statements. This is increasingly common in countries that have adopted IFRS for listing purposes and it shows how far-reaching IFRS reporting requirements may become. CPAs should be alert to and prepared to deal with such situations, of which the following are examples:

The U.S. company has foreign operations. U.S. entities that have or are seeking to establish operations in other countries now may be required by local regulators or lenders to prepare IFRS-compliant statements. This is increasingly common in countries that have adopted IFRS for listing purposes and it shows how far-reaching IFRS reporting requirements may become. CPAs should be alert to and prepared to deal with such situations, of which the following are examples:

A U.S. company issuing debt or equity in a foreign capital market may be required to prepare IFRS statements.

A U.S. company issuing debt or equity in a foreign capital market may be required to prepare IFRS statements.

A U.S. company may be required by the local government, tax or banking regulator to provide IFRS statements.

A U.S. company may be required by the local government, tax or banking regulator to provide IFRS statements.

A U.S. company’s foreign customers, vendors or lessors may require IFRS statements.

A U.S. company’s foreign customers, vendors or lessors may require IFRS statements.

A U.S. company acquired by a foreign business may be required to provide IFRS statements to the acquirer or a government regulator.

A U.S. company acquired by a foreign business may be required to provide IFRS statements to the acquirer or a government regulator.

| Exhibit 3 : IFRS Implementation Timetable | | Date | Required action | | January 1, 2004 | Begin collecting data for opening IFRS balance sheet. The IASB will issue no new standards required to be applied in 2005, so companies will not have to be concerned about new standards of which they are unaware. | | January 1, 2005 | IFRS reporting required in the European Union. | | March 31, 2005 | A small number of EU companies must begin quarterly reporting. | | June 30, 2005 | More EU companies must begin semiannual reporting. | | December 31, 2005 | Annual IFRS financial statements due for the first time. | Source: Deloitte, www.iasplus.com . |  A foreign investor in a U.S. company uses IFRS. If a publicly traded EU company—for example, a bank— owns 20% to 50% of a U.S. company and previously accounted for its investment using a form of equity accounting under its local GAAP, the bank will be required, beginning in 2005, to report under IFRS. Consequently, the U.S. company will have to prepare IFRS information for purposes of its investor’s equity accounting. (Cost accounting applies to ownership stakes smaller than 20%; equity accounting is used for investments greater than 20% but not more than 50%; and ownership of more than 50% constitutes control, making the owned entity a subsidiary of its parent.)

A foreign investor in a U.S. company uses IFRS. If a publicly traded EU company—for example, a bank— owns 20% to 50% of a U.S. company and previously accounted for its investment using a form of equity accounting under its local GAAP, the bank will be required, beginning in 2005, to report under IFRS. Consequently, the U.S. company will have to prepare IFRS information for purposes of its investor’s equity accounting. (Cost accounting applies to ownership stakes smaller than 20%; equity accounting is used for investments greater than 20% but not more than 50%; and ownership of more than 50% constitutes control, making the owned entity a subsidiary of its parent.)

There also may be cases where the foreign parent of a U.S. company has an investor that is required to comply with IFRS. For example, let’s assume that a Japanese company is the sole owner of a U.S. subsidiary. The Japanese parent company reports its consolidated financial statements using local GAAP, while the subsidiary uses U.S. GAAP for its local reporting. Let’s further assume that a publicly traded investor based in Spain owns 20% to 50%, inclusive, of the Japanese company. Because that investor will have to file IFRS statements beginning January 1, 2005, it will need IFRS information to account for its investment in the Japanese company. Therefore, in order to apply the equity method of accounting in the Spanish investor’s IFRS statements, the Japanese company and its U.S. subsidiary both would have to prepare IFRS-based information. Another form of investment—joint ventures—also may have to be accounted for on an IFRS basis if it involves a foreign partner. BENEFITS FOR VOLUNTEERS

In addition to the above cases in which IFRS use is mandatory, CPAs may identify situations when U.S. companies may want to adopt IFRS voluntarily. If such a U.S. company operates in an industry experiencing significant foreign competition, such as banking, insurance, motor vehicle manufacturing, pharmaceuticals or telecommunications, the CPA may advise its management to provide enough IFRS-based information for foreign analysts and investors to be able to compare its performance with that of its peers and consider investing in the company.  | PRACTICAL TIPS TO REMEMBER | |  CPAs shouldn’t underestimate the impact of IFRS on U.S. companies, given regulators and standard-setters’ work to converge IFRS and U.S. GAAP.

CPAs shouldn’t underestimate the impact of IFRS on U.S. companies, given regulators and standard-setters’ work to converge IFRS and U.S. GAAP.  Practitioners should become sufficiently familiar with IFRS to identify situations in which it may not be obvious that a U.S. company has an IFRS reporting obligation. For example, a company that has no ties to foreign entities still may be affected by IFRS-influenced changes in U.S. GAAP.

Practitioners should become sufficiently familiar with IFRS to identify situations in which it may not be obvious that a U.S. company has an IFRS reporting obligation. For example, a company that has no ties to foreign entities still may be affected by IFRS-influenced changes in U.S. GAAP.

CPAs who previously prepared financial statements for a U.S. subsidiary of a foreign company have experience converting U.S. GAAP-based financial statements into equivalents based on French GAAP, for example. These practitioners will, of course, have to familiarize themselves with IFRS as a new basis of accounting.

CPAs who previously prepared financial statements for a U.S. subsidiary of a foreign company have experience converting U.S. GAAP-based financial statements into equivalents based on French GAAP, for example. These practitioners will, of course, have to familiarize themselves with IFRS as a new basis of accounting.

CPAs who work for or have as a client a U.S.-headquartered multinational corporation should be aware that all its subsidiaries that are publicly listed in the European Union must comply with IFRS beginning January 1, 2005. This may require the parent company to include in its consolidated reports a U.S. GAAP version of the subsidiary’s IFRS statements. Consequently, CPAs at the U.S. parent company should be aware of how IFRS reporting requirements could affect the parent company’s consolidated financial statements.

CPAs who work for or have as a client a U.S.-headquartered multinational corporation should be aware that all its subsidiaries that are publicly listed in the European Union must comply with IFRS beginning January 1, 2005. This may require the parent company to include in its consolidated reports a U.S. GAAP version of the subsidiary’s IFRS statements. Consequently, CPAs at the U.S. parent company should be aware of how IFRS reporting requirements could affect the parent company’s consolidated financial statements.

CPAs should be alert to and prepared to deal with situations in which U.S. entities that have or are seeking to establish operations in other countries now may be required by local regulators or lenders to prepare IFRS-compliant statements.

CPAs should be alert to and prepared to deal with situations in which U.S. entities that have or are seeking to establish operations in other countries now may be required by local regulators or lenders to prepare IFRS-compliant statements.

Practitioners should familiarize themselves with IFRS and its differences from U.S. GAAP to advise U.S.-based clients or employers on changes in their financial reporting obligations if they are partly owned by an investor required to report using IFRS.

Practitioners should familiarize themselves with IFRS and its differences from U.S. GAAP to advise U.S.-based clients or employers on changes in their financial reporting obligations if they are partly owned by an investor required to report using IFRS.

A CPA may advise the management of a U.S. company with significant foreign competition to provide IFRS-based information voluntarily so that foreign analysts can compare its performance with that of its foreign peers and consider investing in such a company.

A CPA may advise the management of a U.S. company with significant foreign competition to provide IFRS-based information voluntarily so that foreign analysts can compare its performance with that of its foreign peers and consider investing in such a company.

| | CONVERGENCE

CPAs should be aware that efforts to create global accounting standards not only are changing the role of national standard-setters such as FASB, but also are affecting U.S. GAAP. Greater U.S. participation in the IASB’s activities has influenced its policies more than ever before, as in the development of accounting standards for business combinations. And now the IASB’s standards are about to have a strong impact on U.S. GAAP and financial reporting. Recently FASB and the IASB have formally agreed to converge U.S. GAAP and IFRS. To that end they have begun to coordinate their project agendas, with each board agreeing to undertake projects to amend its current standards. CPAs should stay abreast of these developments to build and maintain their ability to advise their clients and employers on IFRS-related obligations and opportunities. LOOKING AHEAD

Given the efforts to converge IFRS and U.S. GAAP and the trend toward adopting IFRS as the single body of internationally accepted accounting standards, CPAs shouldn’t underestimate their impact. While U.S. companies may find it easier to make the transition to IFRS from GAAP than companies reporting under other bases of accounting, adopting IFRS still may have pervasive and fundamental effects on a company’s financial reporting, creating a need and opportunity for CPAs to identify and explain to company management the benefits of and best practices for IFRS.

|