How to add Journal of Accountancy to your Apple News app

This quick guide walks you through the process of adding the JofA as a favorite news source in the News app from Apple.

iPhone and iPad users with iOS 9 can see articles from sources of their choice—including the JofA and The Tax Adviser—in the News app. Read on to see how you can add the JofA to the News app. (These instructions assume you have already upgraded to iOS 9.)

Step 1: If this is your first time accessing the News app, you will have to select at least one publication from a prepopulated list. You can edit this selection later. If you tap Continue, you will also be given the option to get news articles emailed to you. To do that, click Sign Me Up and proceed to the next screen.

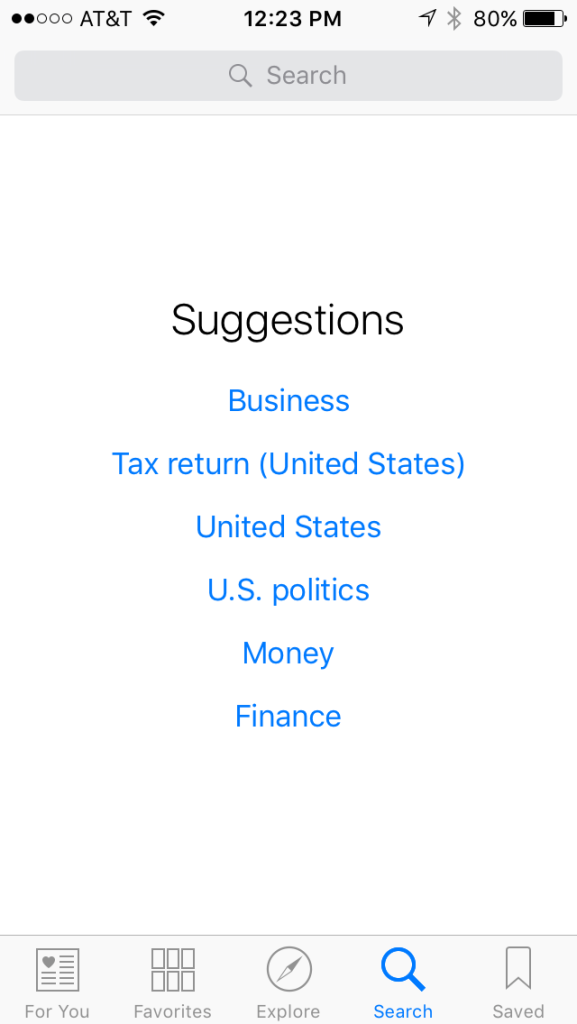

Step 2: You will now be on a screen that has a selection of news from the selected sources. Tap Search at the bottom of this screen, and you will see a screen similar to the one below.

Step 3: Type “Journal of Accountancy” in the search field at the top of the screen. Once you are finished typing, you will see Journal of Accountancy as a Top Hit.

Step 4: Tap the + (plus sign) and Journal of Accountancy will be added to your selection of news sources. The plus sign will become a checkmark.

Step 5: Tap Done. Now, JofA news will appear when you tap the For You tab.

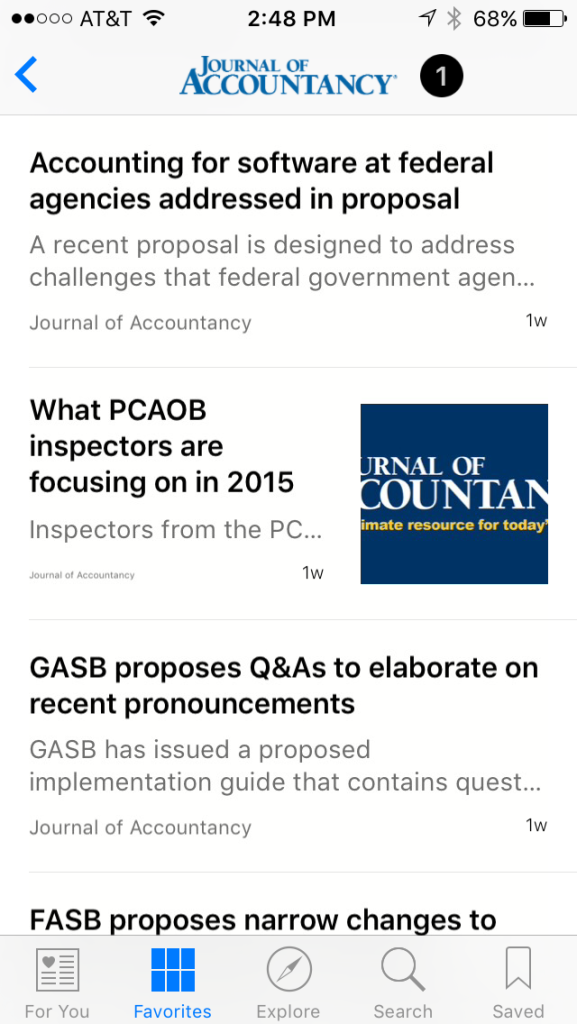

If you tap the Favorites tab, you will see an icon for Journal of Accountancy. If you tap the icon, you will see only JofA articles as in the example below.

To add The Tax Adviser, begin at Step 2 and use “The Tax Adviser” as the search term.