- feature

- GOVERNMENT

A 10-K for the taxpayer

The federal financial report provides a comprehensive look at the U.S. government’s financial metrics and perspective on future issues and challenges.

Please note: This item is from our archives and was published in 2016. It is provided for historical reference. The content may be out of date and links may no longer function.

Related

GASB updates guidance on application of standards

Financial Accounting Foundation issues annual report

GASB issues two exposure drafts for comment

TOPICS

The 2015 Financial Report of the United States Government counters the conventional wisdom that federal accounting is an oxymoron. The financial report is, in essence, a “10-K for the taxpayer.” It has many of the same elements as a private sector company’s annual 10-K report to its shareholders, including, but not limited to, statements of financial position, operating statements, and related disclosures. While a primary focus of the financial report is on the federal government’s activity and results during and as of the end of its fiscal year (Sept. 30), it also provides insight on key prospective trends, including long-term fiscal sustainability.

This article provides an overview of the federal financial report to help CPAs—who play an important role in guiding citizens and policymakers on financial matters—understand the information that is presented. The financial report provides a comprehensive view of the federal government’s finances—its financial position and condition, its revenues and costs, assets and liabilities, and other obligations and commitments, as well as analysis of important financial issues and significant conditions that may affect future operations. Federal financial statements are prepared largely pursuant to accrual accounting principles as prescribed in federal accounting standards, which consider revenues as earned and costs as incurred (see the sidebar “The Role of FASAB”).

FEDERAL REPORTING OVERVIEW

The financial results and activity of more than 150 federal entities are included in the financial report, which is prepared by the Treasury Department in cooperation with the Office of Management and Budget. However, pursuant to current federal accounting rules, other entities that are often thought of as part of the federal government are excluded from the consolidated financial statements, notably the Federal Reserve System. Although the Federal Reserve has been primarily responsible for establishing and executing the nation’s monetary policies, when created it was explicitly granted a degree of independence from usual executive and legislative branch controls. That is why, despite its importance to the economy and the magnitude of its assets and liabilities, under federal accounting rules, it is not consolidated in the basic statements. Still, the report provides extensive information about the Federal Reserve’s relationship to the central government as well as key financial data in note disclosures. The U.S. Government Accountability Office (GAO) audits the financial report (see the sidebar “Inside the GAO’s Audit Disclaimer”), and Treasury typically issues the reports within five months of the federal government’s fiscal year end.

The content of the financial report can be generally characterized in one of two ways: (1) traditional accrual-based financial statements with supporting information; and (2) nontraditional sustainability financial statements with supporting information. Traditional accrual-based financial reporting (in the context of financial reporting) refers to types of information that a user would expect to see in a typical corporate sector financial report (e.g., balance sheet, operating statement, and statement of cash flows). Nontraditional sustainability financial reporting refers to a distinctive feature of federal financial reporting in general and of the financial report in particular—presentation and discussion of the projections of federal revenues and expenditures for the federal government as a whole (fiscal sustainability) and for certain key federal programs (social insurance).

FINANCIAL REPORTING: NUTS AND BOLTS

The report contains eight basic financial statements. Some are readily comparable to those of businesses, while others are unique to the federal government. For example, the government’s operating statement—the statement of operations and changes in net position—presents its costs and operating revenues. Net costs are further disaggregated by component department or agency in the statement of net cost. For FY 2015, the federal government’s bottom line net operating cost of $519.7 billion is largely derived by offsetting gross costs of $4.3 trillion against earned revenues (i.e., for services provided, such as Postal Service fees) of $375.6 billion to arrive at a net cost of operations of $3.9 trillion, and then deducting taxes and other revenues of $3.3 trillion.

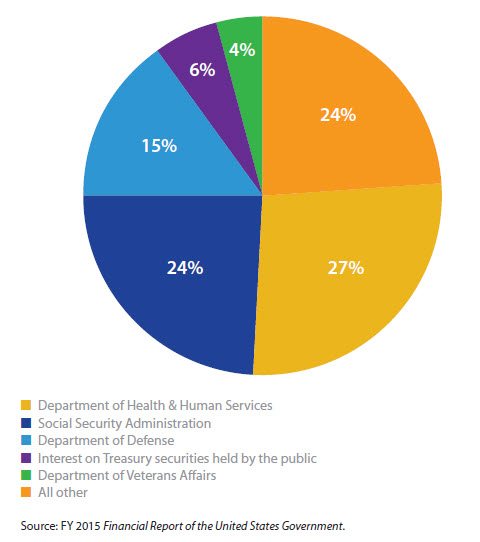

Focusing on the federal government’s $3.9 trillion net cost, by presenting the dollar amounts as percentages (see the chart “Net Cost of the Federal Government, FY 2015 ($3.9 trillion)”), a reader can readily discern that more than two-thirds of the government’s net costs are attributable to three federal agencies: the Department of Health & Human Services, or HHS (27%), the Social Security Administration, or SSA (24%), and the Department of Defense, or DOD (15%). Interest costs on the debt (6%) and Veterans Affairs (4%) are also significant contributors to total net cost. The vast majority of HHS, SSA, and interest costs are considered mandatory, which can potentially make reducing the debt via discretionary spending changes a challenge. The remaining one-fourth of the government’s net cost is attributable to the operations of dozens of other agencies and their programs, including national parks, agriculture, energy, education, and the environment.

Net cost of the federal government, FY 2015 ($3.9 trillion)

Another basic financial statement reconciles the government’s accrual-based, “bottom line” net operating cost to its cash-based “unified budget” deficit, an amount that is primarily cash-based (but excludes key debt-related transactions) and is often considered to be the “official” deficit. As might be expected, the accrual-based net operating cost of $519.7 billion exceeds the largely cash-based deficit of $438.9 billion due mostly to the inclusion in net operating cost of accruals, primarily those associated with increases in estimated liabilities for the government’s post-employment benefit programs as well as the effect of changes in valuations of certain assets and liabilities. A related statement reconciles the unified budget deficit with changes in the government’s cash and other monetary assets. These two reconciliation statements collectively are similar to the statement of cash flows in a private sector company. Over the past five years, increases in revenues and decreases in costs have driven an overall decline in both cash-based budget deficits and accrual-based net operating costs.

The balance sheet is another statement that should appear familiar to most accountants. Like that of a conventional corporate balance sheet, it presents the government’s assets ($3.2 trillion), liabilities ($21.5 trillion), and the resultant negative “net position” ($18.2 trillion). (Note that the figures don’t agree due to rounding.) The largest of the assets is loans receivable ($1.2 trillion), primarily composed of federal student loans. These are followed in size by net property, plant, and equipment ($893.9 billion), approximately 70% of which is attributable to the DOD.

Excluded from balance sheet assets, owing both to the difficulty of assigning meaningful values to them and to their limited utility in informing policy decisions, are “stewardship land,” such as that held as national parks, national forests, and military bases, and “heritage assets,” such as national monuments. Except for military bases, this land is not used or held for use in general government operations and is land that the government does not expect to use to meet its obligations. The financial report does include a note disclosure about the nature of these resources. As discussed in the financial report, it is also important to note that balance sheet assets also do not include the financial value of the government’s sovereign power to tax, regulate commerce, and set monetary policy.

The largest balance sheet liability is federal debt held by the public and accrued interest ($13.2 trillion), which is approximately $5 trillion less than the more well-known $18.1 trillion in debt that was subject to the statutory debt limit as of Sept. 30, 2015. The difference between the two is attributable to intragovernmental debt. Intragovernmental debt holdings represent the portion of gross federal debt that is held as investments by government entities, such as trust funds, revolving funds, and special funds. Since the financial report is a consolidated report, these balances and activity are reported at the agency level but are offset in consolidation, and so they do not explicitly appear on the governmentwide balance sheet but are disclosed in the footnotes.

The other significant liability reported on the governmentwide balance sheet is federal employee and veterans benefits payable ($6.7 trillion). Including “other liabilities,” the total of the government’s balance sheet liabilities for FY 2015 is $21.5 trillion. As was the case with assets, the government’s balance sheet, pursuant to federal accounting standards, does not reflect certain prospective obligations and commitments, such as those related to social insurance programs, mainly Social Security and Medicare.

FISCAL SUSTAINABILITY AND SOCIAL INSURANCE

The current financial report states explicitly that the information and analysis presented imply that the government’s fiscal policies are not sustainable. This conclusion is based upon the “sustainability” financial statements that appear alongside the other federal financial statements and the related disclosures and analysis. The Statement of Long-Term Fiscal Projections, included as a “basic” statement for the first time in 2015, reports the net present value (NPV) of 75-year projections of receipts and noninterest spending, assuming the continuation of current policy—both in present-value dollars and as a percentage of GDP. Further, the related disclosures discuss how the projections changed during the year.

This new financial statement’s focus provides an interesting perspective with respect to the NPV of receipts and expenditures, but the message is much more evident in the displays of these projected trends over time, particularly given the Federal Accounting Standards Advisory Board’s (FASAB’s) definition of fiscal sustainability, which is that debt as a percentage of GDP remains stable or declines over the long term.

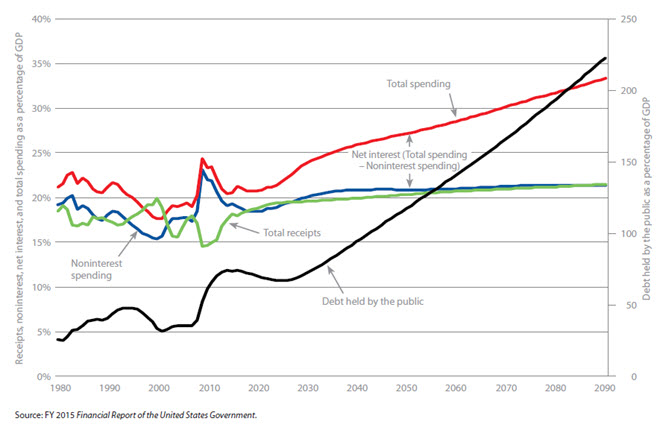

The chart “Historical and Current Policy Projections for Receipts, Noninterest Spending, Net Interest, Total Spending, and Debt, 1980—2090” provides the analysis on which a fiscal sustainability conclusion can be based. It shows that the government’s primary deficit (where noninterest spending exceeds total receipts) has declined significantly in recent years. Moreover, it indicates that it will decline further until it actually turns to a surplus (where total receipts exceed noninterest spending) in 2019. According to the financial report, this short-term trend is largely attributable to revenue changes ushered in via the American Taxpayer Relief Act of 2012, P.L. 112-240, spending controls enacted through the Budget Control Act of 2011, P.L. 112-25, and projected longer-term savings via the Patient Protection and Affordable Care Act of 2010, P.L. 111-148.

Historical and current policy projections for receipts, noninterest spending, net interest, total spending, and debt, 1980–2090

But starting in 2025, the persistent growth in the cost of providing health care, the retirement of the Baby Boomer generation, increasing longevity, and lower birthrates will cause the primary surplus to gradually decline. By 2028 it will again turn to primary deficits, which will remain modest through the end of the projection period in 2090. The problem, however, is not so much with the primary deficit as it is with the resultant increases in both debt and interest. After all, even modest deficits need to be covered with increased borrowing. Hence, taking interest spending into account, the debt-to-GDP ratio, which was 74% at the end of 2015, is projected under current law and policy assumptions to climb to 106% in 2045 and to 223% by 2090.

Thus, as stated in the financial report and shown in the chart, the projected continual rise of the debt-to-GDP ratio after 2025 indicates that current policy is unsustainable (see the sidebar “The Fiscal Gap”). However, the report also notes that the sooner policy changes are put into effect, the smaller the revenue and/or spending changes will need to be to achieve a sustainable fiscal path, with the caveat that policy changes not be implemented so abruptly that they hinder economic growth.

It is important to keep in mind that these debt-to-GDP ratio projections, as well as the underlying receipt and spending projections, are, in fact, projections, not forecasts or predictions. They present projected cash flows under current laws and policies, with some adjustments, such as extension of current policies that expire under current law but are typically expected to continue (e.g., an assumption that scheduled Social Security benefit payments would continue after the related trust funds are projected to be exhausted). Further, it is also important to note that projections such as these, which extend decades into the future, are subject to considerable uncertainty. These important assumptions notwithstanding, their purpose is to serve as a warning that such policies cannot be allowed to continue indefinitely, that change is needed, and that the cost of delay should be considered.

Whereas the statement of fiscal projections and the related analysis address federal government receipts and spending in the aggregate, the Statements of Social Insurance (SOSI) focus specifically on the present value of projected receipts and spending specifically for the government’s social insurance programs, predominantly Social Security and the major components of Medicare. In summary, the SOSI show that under current law and policy, over 75 years, the NPV of projected expenditures exceeds that of receipts by $41.5 trillion for the “open group” (i.e., current participants who have and have not attained eligibility and individuals who are projected to become participants during the 75-year projection period). These projections are affected by similar influences, such as Baby Boomer retirements and health care cost growth, as previously described in the fiscal sustainability discussion above.

Although the SOSI assume that full Social Security and Medicare Part A benefits will continue to be paid after expected trust fund exhaustion, the required supplementary information based largely on the Trustees Reports, underscores that under current law, the Medicare Part A (Hospital Insurance, or HI) and the combined Social Security trust funds will be depleted by 2030 and 2034, respectively, at which times projected benefits payable would continue commensurate with projected income to the funds. Further, based on accounting conventions, the SOSI at the governmentwide level do not include receipt of transfers of general fund revenues (e.g., income and other taxes) that would be required to be made under current law to fund Medicare Part B and Part D benefits, which amounted to approximately $24.8 trillion in the fiscal year 2015 SOSI.

A related Statement of Changes in Social Insurance Amounts indicates by major program the reasons for the increase or decrease in the obligations.

Another noteworthy feature of the financial report is the Management Discussion and Analysis (MD&A). The MD&A provides an assessment of the current fiscal status of the federal government, as well as insights concerning the social insurance and fiscal sustainability projections discussed in this article.

CPAs’ ROLE

Even a CPA may find the 267-page federal financial report highly technical. However, Treasury summarizes the key information and trends in an eight-page Citizen’s Guide, which is incorporated as part of the overall report and also issued as a free-standing publication. Both the financial report and the Citizen’s Guide are available online (at fiscal.treasury.gov and in hard copy.

With federal spending accounting for over 20% of the nation’s GDP and given the role that the federal government plays throughout citizens’ lives, it is important that we all be aware of the government’s current financial position as well as prospective issues and challenges. The financial report and the Citizen’s Guide provide the general public, and in particular CPAs, to whom both citizens and policymakers look for guidance, with an ample resource for improving that awareness and understanding of the federal government’s finances.

The role of FASAB

The 9-member board sets federal accounting concepts and standards.

Most federal agencies material to the financial report prepare their financial statements in accordance with federal accounting principles set by the Federal Accounting Standards Advisory Board (FASAB), which follow accrual accounting principles.

FASAB is one of the three U.S. standard-setting bodies (along with FASB and GASB) to which the AICPA has granted “Rule 203” standard-setting authority. FASAB is composed of nine members, six of whom are “non-federal,” selected from the general financial, accounting, auditing, and academic communities. The other three members represent the three federal agencies that sponsor the board—the U.S. Government Accountability Office, the Office of Management and Budget, and the Treasury Department.

FASAB follows a prescribed due process that includes leveraging subject-matter expert task forces to develop standards; issuing exposure drafts; and soliciting feedback from constituents both inside and outside the federal government, including the AICPA.

Inside the GAO’s audit disclaimer

Defense issues and complexity have led to a disclaimed opinion.

The U.S. Government Accountability Office (GAO) is required to report on the Financial Report of the United States Government but has been unable to issue an audit opinion since the federal government first produced an “official” government-wide consolidated financial report 19 years ago (for FY 1997).

Many of the agencies included in the financial report have been audited either by the GAO or by independent CPA firms, including all of the 39 most significant agencies, which account collectively for more than 99% of the federal government’s total net cost for FY 2015. Most of these 39 agencies have earned unmodified opinions, but the most glaring exception is the Department of Defense (DOD), whose disclaimer stems largely from the agency’s inability to adequately account for its costs and assets, among other issues.

The primary contributors to the GAO’s audit disclaimer on the government-wide financial statements are the accounting issues at DOD and the challenges that the federal government as a whole continues to face to adequately reconcile billions of dollars in intragovernmental financial activity and effectively compile the financial information from more than 150 entities. The federal government has made significant strides toward resolving the material weaknesses in recent years, but much work remains to fully implement the processes and controls necessary to warrant an unmodified opinion.

What’s at stake?

The AICPA describes how to use the U.S. government’s financial statements to understand the nation’s fiscal health at the “What’s at Stake? The CPA Profession on Federal Fiscal Responsibility” webpage. Greg Anton, CPA, CGMA, a past chairman of the AICPA board of directors, founded the “What’s at Stake” initiative and explains in a recent video on the webpage the far-reaching consequences if current policy is kept in place.

The latest video on the webpage encourages CPAs to raise concerns about the deficit with elected officials and candidates for public office. Anton explains that the current deficit trend is unsustainable and asks CPAs to help advance the conversation about the dangers that high deficits pose to the nation’s future.

The fiscal gap

The report’s analysis serves as a warning about current policies

The concept of a fiscal gap—or a measure of the degree to which current fiscal policy is unsustainable—is included in the federal government’s financial report. The fiscal gap is the amount by which primary surpluses over the next 75 years must rise above current policy levels for the debt-to-GDP ratio at the end of the projection period to remain at its 2015 level of 74%.

According to the report, to close the fiscal gap and prevent the debt-to-GDP ratio from rising over the next 75 years from its current level, there would have to be some combination of spending reductions and revenue increases amounting to 1.2% of GDP over that period (or about 6% of projected receipts or projected noninterest spending). However, if the government delays taking such action for only 10 years, the magnitude of the reforms necessary to close the fiscal gap is estimated to increase by 25%.

About the authors

Michael Granof (michael.granof@mccombs.utexas.edu) is a professor of accounting at the McCombs School of Business at the University of Texas at Austin and a member of GASB and the Federal Accounting Standards Advisory Board. Scott Bell (robert.bell@treasury.gov) is a senior staff accountant for the U.S. Department of the Treasury, with more than 20 years of service in the federal government across several agencies.

To comment on this article or to suggest an idea for another article, contact Ken Tysiac, editorial director, at ktysiac@aicpa.org or 919-402-2112.

AICPA resources

Articles

- “Walker Issues Final Report, Asks CPAs to Lead in Fiscal Responsibility,” JofA, Sept. 17, 2013

- “CPAs: Fixing Deficit Should Be Government’s Top Economic Priority,” JofA, Jan. 9, 2013

- “The CPA’s Role in Restoring Fiscal Sanity,” JofA, June 2012

Publications

- Government Auditing Standards and Single Audits—Audit Guide (#AAGGAS16P, paperback; #AAGGAS16E, ebook; #WRF-XX, one-year online subscription)

- State and Local Governments—Audit and Accounting Guide (#AAGSLG16P, paperback; #AAGSLG16E, ebook; #WGG-XX, one-year online access)

CPE self-study

- Audits of State and Local Governments: What You Need to Know (#746212, text; #157942, one-year online access)

- Governmental Accounting and Auditing Update (#736486, text; #186497, text with video; #156485, one-year online access with video)

- Governmental Accounting and Reporting (#746291, text; #163722, one-year online access)

For more information or to make a purchase, go to aicpastore.com or call the Institute at 888-777-7077.

Webpage

What’s at Stake? The CPA Profession on Federal Fiscal Responsibility, aicpa.org