- feature

- PRACTICE MANAGEMENT

How to win the Game of Talent

Firms need planning and persistence to survive on the most competitive battlefield in recent memory for hiring skilled accountants.

Please note: This item is from our archives and was published in 2015. It is provided for historical reference. The content may be out of date and links may no longer function.

![[“We are hiring” yellow banner on white texture background. Job b,How to win the Game of Talent] How to win the Game of Talent](https://www.journalofaccountancy.com/wp-content/uploads/sites/3/2017/03/accounting-hiring.jpg?w=640)

Related

Are you prepared for the cost of a data security incident?

Building a better firm: How to pick the proper technology

Professional liability risks related to Form 1065, CPA firm acquisitions

The HBO show Game of Thrones has generated huge ratings thanks to a fervent fan following that can’t get enough of the story’s many protagonists fiercely fighting for the power and prestige of the Iron Throne.

The world of public accounting has its own skirmish underway. Call it the Game of Talent—and the competition in that arena has been heating up.

“The white gloves are off, and the boxing gloves are on,” said Allan D. Koltin, CPA, the CEO of Koltin Consulting Group, a Chicago-based firm that advises accounting firms on issues including mergers and acquisitions, practice management, and talent recruitment and development. Earlier this year, the head of a large Midwest firm showed Koltin a recruiting letter that all of his staff and partners had received from another firm.

“It used to be that accounting firms would hire search firms” to recruit professionals away from other firms, he said. “Now they hire their own people internally, and they don’t even disguise it anymore.”

Yes, the rules are changing in the Game of Talent. While accounting firms are no strangers to battling for skilled professionals, a trio of factors have contributed to making today’s labor market perhaps the most competitive in recent memory. This article looks at the state of the market and outlines approaches firms can employ to win what Koltin calls “the War for Talent.”

‘THE MARKET IS TIGHT. SUPER TIGHT’

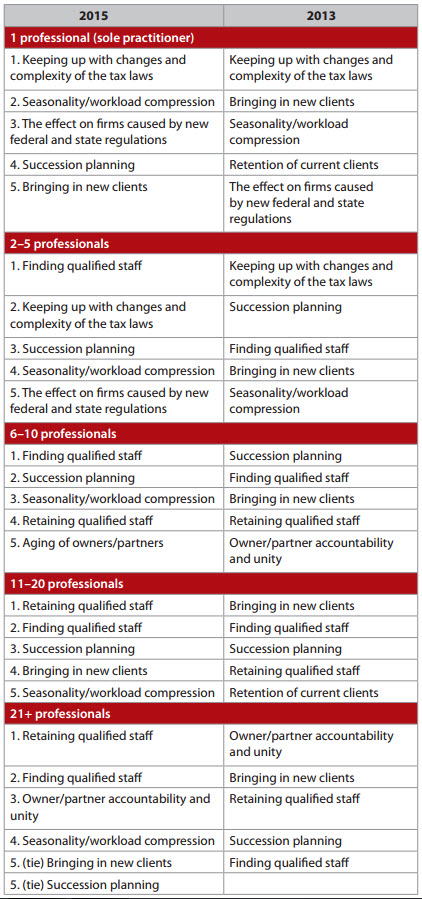

When the AICPA Private Companies Practice Section (PCPS) released the results of its biennial CPA Firm Top Issues Survey earlier this year, staffing concerns topped the list for all firm sizes except sole practitioners (see the JofA news article “Staffing Issues Surge to Forefront of Accounting Firm Concerns.” Finding qualified talent ranked as the top concern of firms with two to 10 professionals and as the No. 2 issue, behind talent retention, for firms with 11 or more professionals (see “CPA Firm PCPS Top Issues Survey Results” chart, below).

Longtime observers of the PCPS survey were not surprised to see talent acquisition and retention at the top of the Top Issues charts. Staffing issues were at the forefront of accounting firm concerns for the first 10 years of the survey, from its inception in 1997 through 2007. The recession pushed client retention to the top of the list in the 2009 survey, while client acquisition became the top priority in 2011 and 2013 as the fight for survival transitioned into the race for growth.

CPA firm PCPS Top Issues Survey results

Today, the cycle has come full circle. Talent is again the name of the game, though the competition has taken on a new edge as the playing field has changed.

“The market is tight. Super tight,” said Jennifer Wilson, co-founder of ConvergenceCoaching LLC and a veteran consultant to accounting firm management teams. “Accounting employment is virtually a full-employment environment.”

Wilson points to blog posts written by her ConvergenceCoaching colleague Renee Moelders, who reported that the estimated average unemployment rate for accountants was lower than 3%, with the U.S. Bureau of Labor Statistics pegging it at 2.2%.

The accounting profession has long enjoyed low unemployment, but a couple of factors have produced a talent shortage that experts including Mark Koziel, CPA, CGMA, AICPA vice president—Firm Services & Global Alliances, describe as more intense than they’ve seen in the past.

The first factor is increased workload compression. The 2014 and 2015 busy seasons were two of the toughest on record due to late changes to tax rules by Congress and inadequate IRS support that made it painfully difficult, if not impossible, for CPAs to get questions answered. Long, frustrating hours during tax season and beyond may be one factor contributing to CPAs’ leaving public accounting.

The second factor is demographics. Baby Boomers heading into retirement and Millennials seeking better work/life balance represent the largest streams of accountants out of public accounting. The loss of Millennials further drains an already thin pool of CPAs with three to 10 years’ experience, perhaps the most competitive front in the battle for talent.

It is on that front that the third factor squeezing the current accounting labor market emerges. The recession caused many accounting firms, especially the largest ones, to cut back on thousands of staff positions—a rare occurrence in public accounting. Many of the accountants laid off or never hired during the recession left the profession entirely, leaving a talent void for many staff positions.

A GAME OF TALENT DOUBLEHEADER

The Game of Talent is played today on two fields. On one side, the goal is to hire experienced talent. On the other, the prize is a steady flow of talent from college campuses.

Of the two, the acquisition of experienced CPAs is the more difficult, while the cultivation of a strong college recruiting program is the lifeblood of many firms.

Some strategies for recruiting experienced talent are explained below.

Game 1: Experienced talent

Public accounting firms seeking to hire CPAs with three or more years in the profession face more than just an uphill climb. It’s more like a mountain, one that firms must scale to secure the prize at the peak—a signed employment agreement with the best candidate available.

Firm recruiters and hiring managers must realize that the mountain isn’t going to come to them. They need the right plan and tools to go to and climb the mountain. And they have to be ready to race other firms to the summit.

“The average senior in recruiting firms I interact with will tell me that they get at least one recruiting hit a day from an external recruiter or a third-party firm,” Wilson said. “So I tell firms, ‘If you’re not reaching in, through an external recruiter or your own full-time recruiter, you are really being naïve, because everyone else is reaching in to your firm.’

“Firms do have to take a more active strategy.”

One of the first parts of that strategy is determining which experienced CPAs to recruit. Wilson divides potential hires into two groups—actives and passives. Actives are CPAs who for a variety of reasons don’t have a public accounting job but are seeking one. Passives are CPAs who are employed at another firm and are not actively looking for another job.

Wilson encourages firms to be proactive in pursuing passives and to pay special attention to CPAs looking for work due to a move to another city or state, often because their spouse got a new job. Firms also should take a close look at CPAs returning to public accounting from industry or after an extended absence, which frequently was taken to concentrate on raising young children.

The best candidate for an open staff position often is a CPA employed at another firm. How can CPA firms attract those talented accountants?

Faulk & Winkler LLC, a 46-employee firm in Baton Rouge, La., relies heavily on LinkedIn in addition to traditional approaches, including an ad in the local newspaper, said Lauren Fitch, J.D., the firm’s COO. Fitch searches for CPAs employed in the Baton Rouge area and then, using the LinkedIn feature that shows how users are connected, looks to see if any of the firm’s LinkedIn contacts know the candidate and could make a connection. She has found this approach to be more effective than directly emailing candidates out of the blue.

“It’s not very successful if it’s a cold touch,” she said. “They probably won’t respond.”

That’s why Fitch seeks warm leads in candidate searches. As part of that process, she has pushed her firm’s CPAs to be on LinkedIn making connections and having meaningful touches with those connections.

![[Journal of Accountancy Print Magazine - Environmental Portrait Photography - October 2015 JofA Issue - Lauren Fitch and Tommy Lejuene,Lauren Fitch, J.D.] Lauren Fitch, J.D.](https://www.journalofaccountancy.com/wp-content/uploads/sites/3/2015/10/lauren-fitch.jpg)

Fitch and Wilson also see alumni as a rich source of experienced talent, though the two are referring to different types of alumni. “Many graduates of Louisiana State University, located in Baton Rouge, move to Texas before moving back when they decide to start a family,” Fitch said. To attract those potential job candidates, Fitch joined LSU alumni associations in Texas and uses the associations’ online message boards and social media groups to advertise job openings.

The alumni Wilson believes firms should target are CPAs who left the firm.

“My No. 1 tip for experienced hire recruiting is make a list of all the people who have left your firm and you almost cried when they left,” she said. “Make a list, put it in Excel … stay in touch every four months or so. Every firm I had do this has had promising results.”

Many firm leaders may question the wisdom of seeking to rehire professionals who already have left their firm once. After all, wouldn’t such a policy encourage employees to seek better positions elsewhere, and wouldn’t the professionals who stayed loyal to the firm harbor animosity toward one who has left and was lured back?

Wilson dismisses those arguments as shortsighted. CPAs may choose to leave a firm for many reasons: significantly more pay for the same role, a chance to advance to a higher position, an opportunity to work in business and industry. Sometimes the grass just seemed greener somewhere else.

“People leave. It’s a reality,” Wilson said. “Sometimes [they] leave to pursue personal motivators (stay at home with kids, try being a controller) to find that they really want to come back ‘home’ to be happy. Firm leaders that take the ‘high road’ and recognize this are seen as mature, strategic, and acting with trust when they welcome a great person back.”

The ideal candidates for boomerang hires are professionals who sincerely regret leaving a firm and who could immediately be productive upon their return, easing the burden on the remaining staff. “When a really great person comes back, it’s like magic to the rest of the team,” Wilson said.

Boomerang hires help mitigate one of the main risks of any hire—culture shock. Accountants who don’t mesh well with a firm’s culture won’t be successful. Fitch, for example, won’t target CPAs who have spent too much time at another firm or in an industry position. While she’ll look at professionals with three to five years’ experience, she usually won’t consider hiring someone with, say, 10 years ingrained in another firm’s culture.

Koltin sees talent acquisition as part of three pillars that support an accounting firm’s staffing efforts. Talent retention and talent advancement also are essential. If firms can’t show potential hires a track record of developing and advancing their best talent, then they are going to struggle to acquire and retain skilled accountants.

“It’s not like you can have an ‘A’ in one of those three and flunk another one,” Koltin said. “You have to really have the whole package. If you have a great story to get people in the door, but it’s a lousy experience, they’ll leave. If you have a great story to get people in the door and a great culture, but you can’t grow them, the average ones stay, and the good ones leave.”

Wilson recommends the firms employ “one-size-fits-one” motivation and engagement strategies to bolster talent retention efforts—a topic the JofA will address in a future article.

Game 2: College recruiting

College recruiting efforts continue to play a foundational role in talent acquisition for CPA firms. Two of the most effective approaches are networking and internship programs.

Networking can take many forms. One of the most important is the firm’s website, which often is one of the firm’s first points of contact with potential hires, as it is with potential clients. As such, firm websites should feature recruiting sections and material. Faulk & Winkler has a PDF geared specifically toward college students.

Firms also need to be active on local college campuses. “It’s very important to know the career center at each university,” said Fitch, who recruits students from LSU and also Southeastern Louisiana University, which is in Hammond, La., 45 miles east of Baton Rouge. Faulk & Winkler does interviews twice a year on both campuses and also attends Southeastern Louisiana’s career fair and a business school networking event at LSU.

The firm also holds meetings for the Beta Alpha Psi chapters at both LSU and Southeastern Louisiana and sponsors a couple of $1,000 scholarships at LSU.

Internship programs may be the most effective way to develop a strong pipeline of college talent. “You can’t make it without internships,” said Fitch. “They evaluate you. You evaluate them.”

Firms of all sizes across the country have employed a variety of successful approaches to internships. Here are a few:

- Rea & Associates, a firm with 85 CPAs and 11 Ohio offices, brings in 10 interns every January to help with busy season, said Pat Porter, the firm’s human resources director. The firm aims to convert 30% to 50% of its interns into full-time employees after graduation. Because the firm’s offices are in what Porter calls regional Ohio towns, including New Philadelphia, where Rea was founded, he focuses his recruiting efforts on the schools closest to those offices—including Bowling Green State University, Kent State University, Ohio University, Ohio Northern University, the University of Akron, and the University of Mount Union.

- Reiss Jackson & Co., a 10-person firm based in Redlands, Calif., recently teamed up with Brigham Young University—Idaho on an internship program, said Cole Jackson, CPA, one of the firm’s partners. While Jackson would like to work with colleges closer to the firm’s location about an hour’s drive east of Los Angeles, most of the nearby schools operate on the quarter system. This means that their intern candidates can’t work the entire busy season, but instead have to return to school in mid-March. BYU—Idaho operates on a trimester system that allows interns to work at Reiss Jackson from January through April 15. Jackson has hired the firm’s 2015 intern, who graduated in July, and the firm expects to participate in the program again next year.

- Brown Smith Wallace, a 240-employee firm based in the St. Louis area, uses a multistep approach to bringing in interns. Every summer, the firm brings in a group of college juniors to participate in its Impact Leadership Program. The firm expanded the program this year to include two sessions with a total of 30 participants. The firm brought the students in for two sessions of 15 students each. From those 30 people, the firm hired seven, said Christopher Menz, CPA, partner in charge of marketing and business development. The approach has helped the firm grow from 100 people a decade ago to 240 today.

- Faulk & Winkler relies on a pair of internship programs. The first program calls for students to work 20 to 25 hours a week. The second, through an “externship” program with LSU, provides students the opportunity to work full time during busy season while also receiving three hours of course credit. “We cannot succeed in providing exceptional client service without hiring and developing talented people,” said Tommy LeJeune, CPA, the Faulk & Winkler partner who oversees the firm’s recruiting efforts. “Our approach to recruiting embraces the same principle of business and client development, building relationships. We utilize our staff, clients, and relationships with professors and career service professionals at local universities to identify and recruit quality candidates.”

![[Journal of Accountancy Print Magazine - Environmental Portrait Photography - October 2015 JofA Issue - Lauren Fitch and Tommy Lejuene,Tommy LeJeune, CPA] Tommy LeJeune, CPA](https://www.journalofaccountancy.com/wp-content/uploads/sites/3/2015/10/tommy-lejeune.jpg)

STARTING EVEN EARLIER

Firms have even started recruiting potential CPAs in high school. McGladrey hosts open houses for high school seniors who have been offered early decision at universities the firm partners with, said Jennifer Busse, senior director of talent acquisition for McGladrey. At these events, students and their parents can meet representatives of partner universities, who make a case for why students should attend their school.

“We let them know we’ll be in touch with them throughout the course of their college career,” Busse said. Though such tactics may sound aggressive, Busse said they’re necessary nowadays: “That’s what you have to do to keep up.” She notes that many firms now give signing bonuses to interns who accept employment offers right away.

A WINNING PLAN

Accounting firms today face historically difficult competition to hire skilled professionals. Firms need to have plans in place to battle for talent, both coming out of college programs and from other firms. Firms can solidify their position with strong talent retention and advancement efforts—topics that will be covered in future JofA articles. Talent is the lifeblood of growing, thriving CPA firms. The firms with the most potent pipeline of fresh talent will rule the day. The competition for accounting’s Iron Throne is only intensifying. Firms must step up to the challenge to win the game.

(Courtney Vien, a JofA associate editor, contributed to this article.)

Accounting grads in demand

For an in-depth look at the results of the AICPA’s latest survey on the supply and demand for accounting talent, see “Hiring at Public Accounting Firms Hits All-Time High,” page 24.

About the author

Jeff Drew is a JofA senior editor. To comment on this article or to suggest an idea for another article, contact him at jdrew@aicpa.org or 919-402-4056.

AICPA resources

JofA articles

- “Staffing Issues Surge to Forefront of Accounting Firm Concerns,” June 9, 2015

- “Drive Competencies and Develop Talent,” Feb. 2015, page 44

- “How to Start and Run a Mentoring Program,” March 2014, page 34

Publications

- Compensation as a Strategic Asset (#090493, paperback)

- Leading an Accounting Firm: The Pyramid of Success (#PPM1201P, paperback)

- Securing the Future (#PPM1307HI, vol. 1 & 2 set, paperback; #PPM1305P, vol. 1, paperback; #PPM1305E, vol. 1, ebook; #PPM1306P, vol. 2, paperback; #PPM1306D, vol. 2, PDF, online access)

CPE self-study

- Audit Staff Essentials, Levels 1—3 (#159484, #159494, #159504, one-year online access)

- CGMA Learning Program: Strategic Management Accounting (#165350, one-year online access)

- Preparation, Compilation and Review Staff Essentials (#164350, #164360, #164370, one-year online access)

- Tax Staff Essentials, Levels 1—4 (#157631, #157721, #157791, #157861, one-year online access)

Conferences

- Women’s Global Leadership Summit, Nov. 12—13, San Francisco

- Practitioners Symposium and Tech+ Conference, June 5—8, Las Vegas

For more information or to make a purchase or register, go to cpa2biz.com or call the Institute at 888-777-7077.

Private Companies Practice Section and Human Capital Center

The Private Companies Practice Section (PCPS) is a voluntary firm membership section for CPAs that provides member firms with targeted practice management tools and resources, including talent recruitment and retention tools in the Human Capital Center, as well as a strong, collective voice within the CPA profession. Visit the PCPS Firm Practice Center at aicpa.org/PCPS.